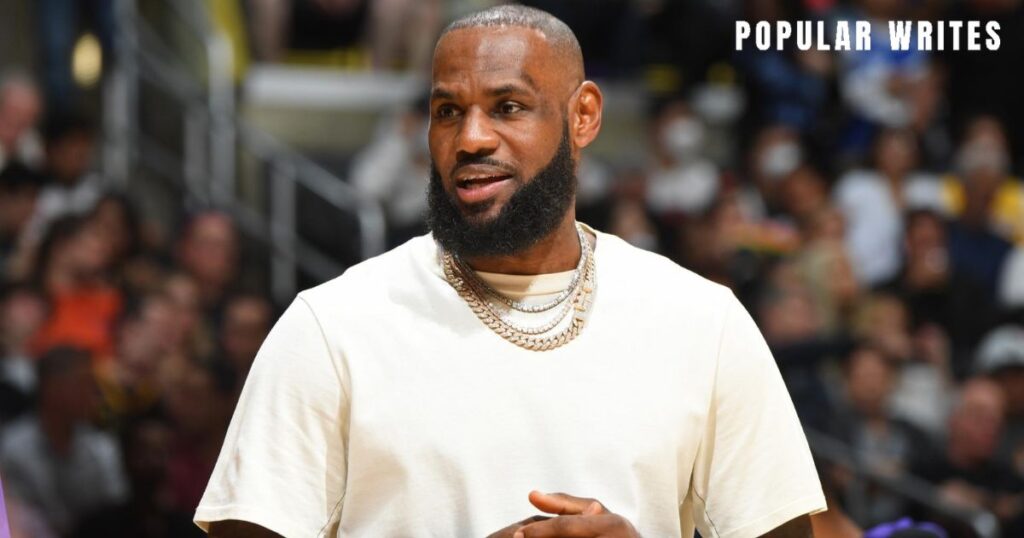

When you think of basketball greatness, one name dominates the conversation LeBron James. Known as “The King,” he’s not only one of the best players in NBA history but also one of the richest athletes in the world. From his record-breaking contracts to his booming business empire, LeBron has built a financial legacy that extends far beyond the basketball court.

In this detailed breakdown, we’ll explore LeBron James net worth, his salaries, endorsement deals, and smart investments that turned him into a billionaire. You’ll also discover how his off-court ventures like SpringHill Entertainment, Blaze Pizza, and Lobos 1707 Tequila have helped shape his empire.

Table: Quick Overview of LeBron James Financial Profile

| Category | Details |

| Full Name | LeBron Raymone James Sr. |

| Profession | NBA Player, Entrepreneur, Investor |

| Team (2025) | Los Angeles Lakers |

| Net Worth (2025) | $1.2 Billion (Estimated) |

| NBA Salary (2025) | $47 Million |

| Endorsements | Nike, PepsiCo, AT&T, Walmart, Intel |

| Businesses | SpringHill Entertainment, Blaze Pizza, Lobos 1707 Tequila |

| Residence | Brentwood, Los Angeles |

| Philanthropy | LeBron James Family Foundation, I Promise School |

LeBron James Salary

LeBron’s NBA salary has been massive throughout his career and remains one of the league’s top paychecks. For the 2023–2025 window his deals with the Lakers paid tens of millions per season, with extensions pushing his yearly base salary well into eight figures. Those numbers alone vaulted his career earnings past half a billion dollars from NBA paycheck alone. His salary deals also included bonuses, incentives, and opt-ins that smartly matched the rising salary cap.

Teams pay LeBron not only for points but for influence, ticket sales, and marketing power. His presence moves merchandise, sponsorships, and local economies. Contract negotiators value that ripple effect when building superstar deals. As a result, his salary structure looks less like a player contract and more like a rights deal for a global brand.

What is LeBron James Net Worth and Salary?

As of 2025 LeBron’s net worth is estimated in the $1 billion+ range thanks to player salary, endorsements, and equity stakes. His annual combined earnings salary plus off-court income often exceed $100 million. That blend of active income and equity deals is the backbone of his long-term wealth strategy. The figure everyone cites reflects both liquid assets and long-term holdings.

His salary remains a meaningful part of yearly cash flow but not the largest wealth builder anymore. Equity stakes in companies like Blaze Pizza and SpringHill have produced outsized returns. Add lucrative long-term Nike royalties and media valuations and you see why he crossed billionaire status. His money model is permanence over flash.

Annual Income

LeBron’s annual income varies with seasons but typically includes NBA salary, bonuses, endorsements, media payouts, and investment returns. In peak years he’s reported more than $100 million in combined earnings, with endorsements sometimes out-earning his salary. Social media deals, sponsorship appearances, and production revenue all add up and smooth income across off-seasons. This diversified stream makes his cashflow reliable even as playing years wind down.

Taxes and team obligations reduce headline numbers, but his after-tax and reinvested returns remain substantial. LeBron and his team employ accountants and advisors to optimize wealth and protect legacy assets. He often prefers equity over one-time payments, which grows net worth faster over decades. That’s why annual income is one metric but not the full picture of his financial health.

Salary & Career Earnings

LeBron’s cumulative NBA salary over his career has crossed the half-billion mark, with new extensions pushing it higher. Add endorsements and business profits and his career earnings well exceed a billion dollars in total receipts. Those totals reflect consistent top-level production and prudent dealmaking across three decades in pro basketball. Major contract renewals and veteran max deals drove the most significant jumps in cumulative pay.

Career earnings also reflect LeBron’s marketability and longevity, not just performance. His ability to remain elite year after year has translated into large salary multipliers and sustained endorsement interest. That longevity is rare and gives him leverage most athletes lack. The result is a career earnings profile that looks like both a sports legacy and a long-term business plan.

lebron james shoe size

LeBron wears roughly a size 15 shoe a detail that matters for performance gear and signature sneakers. Shoe size affects on-court comfort and shoe design, so Nike engineers tailor LeBron’s line for stability and power. His signature shoes blend performance tech with consumer fashion, helping them sell to athletes and casual fans alike. That crossover has made the LeBron shoe line one of Nike’s consistent revenue drivers.

Shoe royalties are a quietly large part of his income stream. A successful sneaker series can generate recurring revenue for decades. LeBron’s early Nike deal and later lifetime arrangement mean shoe sales compound his wealth long-term. The shoe line also anchors brand collaborations beyond footwear.

lebron james body pillow

Fan merchandise like body pillows shows how LeBron’s brand extends into lifestyle products. These novelty items serve superfans and collectors and demonstrate how athlete brands monetize passion points beyond sport. Small-ticket merch like pillows and tees scales easily and diversifies his earnings. It’s a reminder that modern athlete income combines big deals with many small, steady revenue sources.

Merch income might seem tiny compared to big endorsements, but scale matters. Thousands of small purchases add up to reliable revenue, and they keep fans connected. LeBron’s team licenses his image to partners who handle production and distribution. That arrangement produces passive income without adding to his operational load.

Also Like To Read This: Christen Whitman Net Worth: Surprising 2025 Fortune Exposed

lebron james mask

LeBron’s face mask stint in 2014 turned necessity into a memorable image moment in the NBA. After a facial injury he wore protective gear that became widely recognized by fans and media. Such visual moments feed brand storytelling and keep athletes culturally relevant outside technical stats. Even equipment choices become part of a larger public narrative.

Brands and memorabilia makers often capitalize on iconic visuals like that mask. It’s another example of how small moments can create licensing and merchandising opportunities. For LeBron, these chances compound with time and build cultural value. The mask era remains a fun footnote in his career storytelling.

lebron james high school jersey

LeBron’s high school jersey from St. Vincent–St. Mary is collectible and symbolic, reflecting his origin story. Early fame as a high school phenom helped shape his brand before the NBA draft and created lasting nostalgic demand. Collectors prize early memorabilia because it represents the start of a historic career. That jersey marks the transition from local prodigy to global superstar.

Those artifacts also support charity auctions and museum exhibits tied to LeBron’s foundation and legacy projects. Memorabilia sales sometimes fund community programs or special events. So the value of such items isn’t purely monetary it also fuels giving and storytelling. That dual use fits LeBron’s long-term approach to influence.

lebron james body fat percentage

LeBron maintains elite conditioning with a body fat percentage typically reported in the low single digits, helping his performance at 6’9″. That low level reflects targeted training, nutrition, and recovery investments. He spends heavily on personal staff and technology to preserve peak conditioning year after year. That investment supports longevity and directly impacts on-court earning power.

Health spending is a strategic expense that extends earning years. Cryotherapy, hyperbaric chambers, bespoke diets, and trainers all contribute to longer peak performance. Those costs are high but produce outsized returns through extended contracts and fewer injuries. In LeBron’s case, physical maintenance is a business decision as much as a personal one.

Endorsement Deals

LeBron’s endorsement portfolio includes global household names such as Nike, PepsiCo, AT&T, and Beats by Dre. These deals bring massive annual payouts and often include equity or royalty structures rather than flat fees. Equity deals matter more for long-term wealth because they appreciate alongside company value. That structure helped propel LeBron’s transition from high-paid athlete to billionaire owner.

Endorsements also amplify his reach and create cross-promotion opportunities for his own ventures. When he promotes a partner he often integrates product placement with SpringHill content or other business interests. This integrated model creates synergies that outperform one-off ads. In short, endorsements fuel both present cashflow and future asset value.

Nike Deal

LeBron’s Nike relationship started as a rookie deal and later became a lifetime contract said to be worth north of $1 billion. Nike builds premium products and facilities around the LeBron brand, which signals mutual long-term commitment. Lifetime deals shift the payment model from immediate cash to ongoing royalties and brand-building support. That approach secures income well beyond his playing years and cements cultural legacy.

Nike also invests in innovation through facilities like the LeBron Innovation Center, keeping his brand relevant. Those investments support product development and enhance resale value for LeBron-linked collaborations. The Nike tie remains central to his financial architecture and cultural footprint. It’s among the most pivotal deals in sports business history.

Contracts

LeBron’s contracts over time reflect strategic choices: short-term deals when cap growth mattered and long-term security as priorities shifted. He famously took shorter deals in Cleveland to maximize future earnings potential as the salary cap rose. Later he negotiated veteran maximums and multi-year extensions that locked in massive guaranteed sums.

Contract strategy also considered legacy and control; he sometimes chose team fit and championship chances over immediate money. Those moves affected endorsements and legacy value far beyond the contract numbers. LeBron’s deal-making is a case study in combining athletic timing with financial foresight.

Will LeBron James Be A Billionaire?

LeBron crossed billionaire status in the early 2020s thanks to investments, equity deals, and continuing earnings from sport and media. That milestone reflects both massive on-court pay and powerful off-court ownership positions. His holdings in SpringHill, Blaze Pizza, and stakes via Fenway Sports Group contributed heavily. Hitting $1B didn’t happen by chance it was the result of decades of strategic choices.

So the question is settled: he already is a billionaire, and his trajectory suggests continued growth. Wealth now focuses on legacy, investments, and philanthropy rather than mere accumulation. LeBron’s financial moves increasingly emphasize creating institutions and lasting community impact. That shift marks the difference between celebrity wealth and dynastic capital.

Early Life

LeBron Raymone James Sr. was born in Akron, Ohio, and raised by a single mother in challenging circumstances. He rose quickly as a basketball prodigy at St. Vincent–St. Mary High School, drawing national attention and media profiles. That early spotlight shaped his brand and set a platform for smart career decisions. His upbringing also influenced his philanthropic focus later in life.

Those roots are central to both his story and his foundation’s mission. LeBron often references Akron in interviews and projects, underscoring the link between identity and giving back. The “kid from Akron” narrative remains a core part of his appeal. It explains why he invests heavily in hometown initiatives and youth programs.

Personal Life and Real Estate

LeBron married Savannah James and they have three children: Bronny, Bryce, and Zhuri. Family life influences where he chooses to live, invest, and build legacy projects like the I Promise School. He keeps family close and often involves them in brand and philanthropic decisions. That unity shapes both public image and private planning.

His real estate portfolio includes high-value homes in Brentwood, Beverly Hills, and Akron plus other holdings across the U.S. Those properties serve as private retreats and business assets. Real estate also offers diversification and tax planning benefits. For LeBron, homes are both lifestyle and long-term wealth vehicles.

SpringHill Entertainment

SpringHill Entertainment, co-founded with Maverick Carter, focuses on sports-driven content and cultural storytelling. The company produced Space Jam: A New Legacy and other large-scale media properties. That production arm created new revenue lines distinct from play or endorsements. Media value grows as content libraries appreciate and licensing deals multiply.

SpringHill’s valuation and partial-sale events boosted LeBron’s net worth significantly. The company also provides a platform for athlete-driven storytelling and brand partnerships. It’s a strategic vehicle for influence and long-term cashflow. As media consumption shifts, SpringHill positions LeBron in the center of content ownership.

Blaze Pizza

LeBron’s early investment in Blaze Pizza became a standout example of athlete entrepreneurship. He invested early and promoted the brand, converting visibility into meaningful equity returns as the chain scaled. Blaze’s growth produced a multi-fold return relative to initial stake size. That success highlighted the power of aligning athlete credibility with fast-growth startups.

Beyond financial return, Blaze offered LeBron lessons in operational investment and franchise scaling. His choice to favor Blaze over renewing a McDonald’s sponsorship reflected long-term thinking. The Blaze case remains instructive for athletes evaluating endorsement vs equity trade-offs.

Fenway Sports Group

LeBron’s deal with Fenway Sports Group broadened his exposure to team ownership and global sports assets. Through FSG he holds stakes tied to Liverpool FC and is connected to a portfolio of storied franchises. Team ownership aligns with long-term appreciation potential and recurring revenue streams from broadcast and commercial rights. For LeBron, it’s a de-risked path into ownership without managing day-to-day operations.

FSG’s scale and historical growth make such stakes particularly valuable. They also diversify his holdings internationally, balancing U.S.-centric assets. Team equity links sports legacy with capital appreciation a natural fit for a player transitioning into post-playing influence.

Bronny, Bryce James Bringing in the Big Bucks, Too

Bronny and Bryce are carving out their own public profiles and early earnings through NIL and sponsorships. Bronny’s college exposure and social media presence already attract brand interest and create early cashflow. LeBron’s guidance and network give his sons access to opportunities most prospects don’t see. That support accelerates their ability to monetize future basketball and media careers.

Their potential earnings will feed into a multi-generational family strategy rather than raw celebrity cash. LeBron’s goal often seems to be building family institutions that endure. The combined family income and business network create a powerful compounding effect across generations.

James Is One of the Wealthiest Athletes of All Time

LeBron ranks among the top-earning athletes ever, sitting near icons like Jordan, Tiger, and Mayweather on lifetime earnings lists. That placement reflects consistent elite performance plus savvy deal structure and equity stakes. Many athletes earn large sums, but few translate that into diversified, appreciating holdings at this scale. LeBron’s financial profile mirrors the transition from paycheck to perpetual income.

His status also amplifies philanthropic potential and legacy influence. Wealth at that level buys capacity to fund schools, foundations, and long-term initiatives. LeBron positions himself to be remembered for impact as much as for trophies.

The Extension Has Made James the Highest-Earning Player of All Time

Recent contract extensions pushed LeBron past all peers in cumulative NBA salary, making him the highest-earning player in league history. That milestone signals both an extraordinary career and smart negotiation timed to salary cap growth. Guaranteed money and maximum veteran deals ensured his cumulative numbers would eclipse previous records. Those records are financial testaments to both longevity and value.

Being highest-earning is both personal gain and public metric it shows how far athlete compensation has evolved. LeBron’s placement drives conversations about player rights, revenue sharing, and legacy planning. It also provides a precedent for future superstars negotiating long careers.

His Endorsements Include AT&T, Walmart, Intel, Kia, and More

LeBron’s wide brand roster demonstrates cross-industry appeal from tech to food to telecom. Long-term alignment with consumer brands keeps him visible and profitable in multiple demographics. These partnerships create both immediate campaign income and deeper equity opportunities. Brand diversity also cushions against sector-specific downturns.

Partnerships often include co-branded products, ads, and integrated media campaigns with SpringHill or other ventures. That integration makes endorsements more than transactional ads they become strategic business moves. The result is durable brand synergy that supports long-run value creation.

James Is Active on Instagram, Another Source of Income for The King

LeBron’s social media presence reaches hundreds of millions of followers and commands high fees per sponsored post. Platforms like Instagram function as modern media channels, enabling direct monetization and promotion of his ventures. Sponsored content and affiliate links contribute steady income while amplifying other business lines. His digital reach is effectively another studio and billboard all in one.

Beyond direct cash, social platforms support storytelling and community building for his brands. Engagement metrics make him attractive to new partners and help test product launches. In today’s market, social influence equals commercial leverage and LeBron has it in spades.

FAQ’s

Who is the 3 richest NBA player?

The three richest NBA players are Michael Jordan, LeBron James, and Magic Johnson. Their combined wealth exceeds $4 billion.

Is LeBron James a billionaire now?

Yes, LeBron James officially became a billionaire in 2022, making him the first active NBA player to do so.

Who is richer, Ronaldo or LeBron?

Cristiano Ronaldo is richer than LeBron James, with an estimated net worth of around $600 million compared to LeBron’s $550 million (excluding investments).

What is Elon Musk’s net worth?

As of 2025, Elon Musk’s net worth is estimated to be around $240 billion, making him one of the world’s richest individuals.

Is Steph Curry a billionaire?

Steph Curry is not officially a billionaire yet, but his net worth is nearing $200 million through NBA earnings and endorsements.

What NBA player gave up $100 million?

Dennis Schröder famously turned down a $84 million contract with the Lakers, which cost him nearly $100 million in potential earnings.

Conclusion

LeBron James financial story is a hybrid of athletic dominance, smart investing, and media entrepreneurship. His game earned the platform; his deals and investments turned it into lasting wealth. From Nike lifetime royalties to SpringHill content and team ownership, his assets are built to outlast his playing days.

That combination elite performance plus strategic equity explains why LeBron James net worth sits among the highest in sports history. He balanced risk and patience, transforming celebrity into institutions that will define his legacy. For anyone studying athlete wealth, his path offers a valuable blueprint.